First Time Home Buyer Requirements

And many of these dont require any repayment if you live in your home for a certain time frame.

First time home buyer requirements. Department of hud 2019 annual report. As a first time homebuyer there might be a lot of unknowns. Ideal for first time home buyers low 35 down payment requirements favorable credit score requirement of 580 fha loans are the 1 loan type in america with 1141 of all single family residential mortgage originations and 1 market share for first time home buyers at 8284. Homepath ready buyer buyer has not owned a home in three or more years.

Contact a real estate agent and check with both your state and county to learn more about what options are available to you. How to qualify you may qualify as a first time home buyer if you havent owned your principal residence in the past three years. Purchasing a home for the first time can be a daunting task. Understanding the process and requirements for your first mortgage can help you plan and uncover any surprises upfront saving yourself from unneeded headaches down the road.

Local grants to first time home buyers. There are programs that are designed to help those who are making a first time home purchase. First time home buyer benefits. We want to help you learn about few of the things that can slip under the radar as youre getting ready to buy your new home.

First time home buyers love fha loans. First time home buyers know the basics and improve your fha loan chances. Were here to help you. Buying a home has costs associated with it.

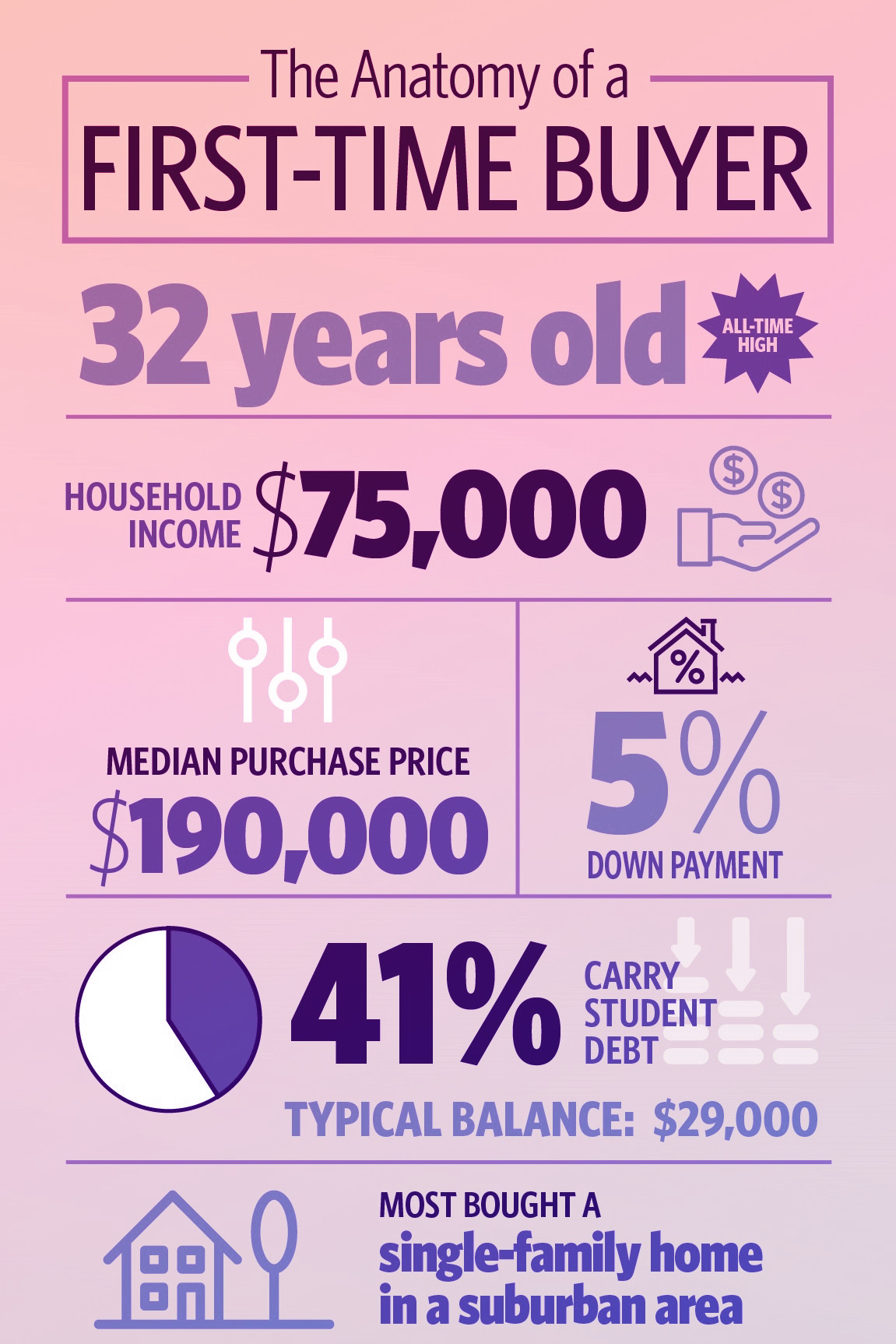

First time home buyer infographic. First time homebuyer requirements buying your first home can seem overwhelming but take a deep breath. The main reason fha loans are so popular is because of their low down payment and credit requirements. There are many local grants available for first time homebuyers.

Whether its the mortgage lingo type of home loans or even down payment requirements the flood of new information can be overwhelming. These are programs that allow previous homeowners to qualify for programs that are targeted to first time homebuyers. Some loan programs have a zero down payment requirement while many first time homeowner programs require 3 to 10.